Meet the man helping overseas student debtors find their way home articles

Date

24 Apr 2025

Related Expertise

Written by Rob Stock for The Post, dated April 22nd 2025, Republished with permission.

Meet former tax investigator turned saviour of errant overseas-based student loan borrowers, Dave Ananth.

In the past six months Ananth has negotiated to have $263,324 in penalty interest wiped from the student loans of eleven overseas-based borrowers (referred to by the revenue minister as OBBs), and one who had returned to New Zealand, in deals that saw them pay off the remainder of their loans immediately.

As a result, Ananth says, $294,867 of student loan debt and interest was repaid to the Crown.

Those 12 borrowers in their late 30s and early 40s, who were all skilled professionals, dug into savings, extended home loans and borrowed from family to make those repayments.

Those living overseas now felt free to return to New Zealand to visit friends and family without fear of being pulled aside at the airport when they tried to leave. The other was already here, having returned home.

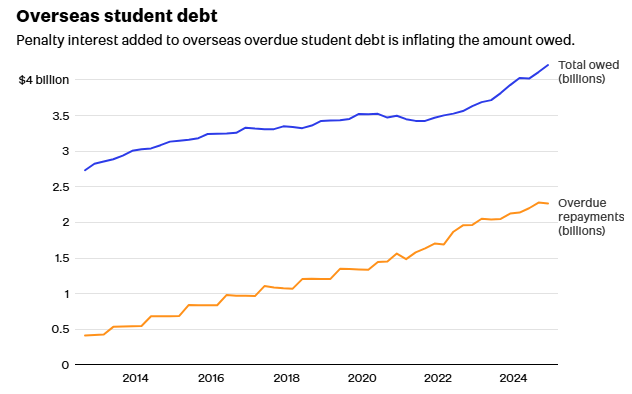

Ananth is an Auckland-based special counsel specialising in tax working for Stace Hammond law firm. But in recent months he’s found himself helping overseas-based New Zealanders desperate to clear their share of the roughly $2.3 billion of overdue student debt owed by people now living overseas.

Many young people with student loans head overseas after graduating, and many fail to make the repayments leaving them accruing penalty interest at 8.9%.

While it is hard to fall overdue on student loan repayments while living in New Zealand, as repayments are deducted from wages, debtors moving overseas have to make periodic repayments themselves.

For decades many have failed, though Inland Revenue now has an online platform borrowers living overseas can use to manage their loans and extensive information on its website.

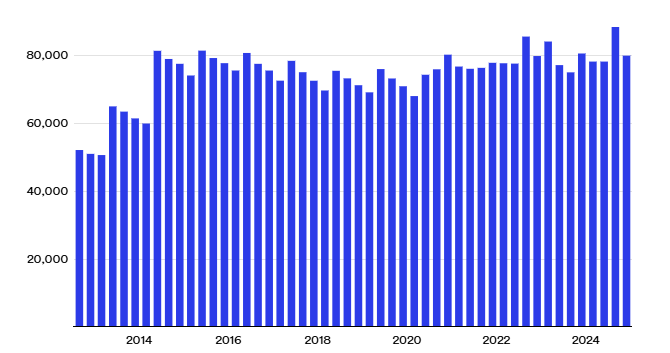

Nearly 80,000 are behind on their repayments, and Ananth thinks it is time the country faced up to the mess.

One of those who Ananth helped negotiate a reduction in penalty fees for spoke with The Post, but asked not to be named because of the shame she felt, and the damage it could cause to her reputation and business.

She felt the student loan system had design flaws that inevitably led to high numbers of young people failing.

“The brain does not fully develop until you are 25,” she said.

Yet 18-year-olds were taking on huge student debts and then just a few years later heading overseas with little idea of what could happen if they failed to make repayments.

“It’s a system designed to fail,” she said.

ALEX RONSDORF/UNSPLASH

She left the country with a $45,000 student debt. When she returned it was over $100,000 thanks to accrued interest and penalties. The repayments when she got home were cripplingly high.

How had she let it get that bad?

“Smart people make silly decisions,” she said.

Ananth said that sentiment was a common thread in allborrowers’ stories: “I was just dumb and stupid. I had my head in the sand.”

“All of these people began when they were in their 20s when they left,” Ananth said.

Another common thread was all acknowledged their debts and wanted to repay them.

In the borrowers’ contacts with Inland Revenue after she returned, nobody had suggested she was entitled to ask for penalties to be waived, or reduced, under clause 146 of the Student Loan Act, which reads: “The Commissioner may, having regard to the circumstances of the case and if the Commissioner considers it equitable to do so, grant relief to the borrower by cancelling as much of the late payment interest as the Commissioner considers equitable.”

The woman contacted Ananth when she stumbled over a blog he had written after helping someone negotiate with the Inland Revenue to have penalties waived in return for a full repayment of the rest of his loan.

She had been having panic attacks over her debt, waking up in the small hours drenched with sweat and fear.

Ananth negotiated for her, charging only a nominal fee, making a case which included setting out the crushing anxiety the woman was suffering and the financial struggles of the family.

When she got the news some of the accrued penalties were being wiped, she said: “It was like this immense weight was gone.”

Overdue and overseas

There are around 80,000 student loan borrowers with overdue repayments.

She was not a person given to dancing for joy, but she said on this occasion, she did.

“The last 15 years of guilt and shame were gone in a day. It was unbelievable.”

She would like to see a thorough review of the student loan system, including to give more people the opportunity to argue to have their penalties waived.

Making the system less “punitive” could help attract some of those 80,000 overseas debtors to return, even if only to see ageing family and introduce children to grandparents they had never met.

Currently, change does not appear to be on the political agenda.

The tack the country has taken is to allocate millions to paying debt collectors like Baycorp to chase down defaulting borrowers overseas, including door-knocking them at home.

The policy is having an effect. One of Ananth’s dozen re-payers was motivated to finally deal with their chronically overdue loan after such a visit.

KELLY HODEL / WAIKATO TIMES

“Suddenly the kids say, ‘Dad, what’s going on with your student loan?’ It’s embarrassing.”

“That’s scary for people who are 40s, who have got kids at home,” said Ananth, who has not charged commercial rates to any of the people he has negotiated for.

Ananth would like to see the Government consider wiping penalties accumulated for highly skilled people wishing to return home, or hold an amnesty by wiping penalties for people who made one-off full repayments.

He would also like it to work with the Australian Tax Office to prevent future generations of young people from falling into the same trap.

Revenue Minister Simon Watts was not planning on a policy change on OBBs in default.

“New Zealand’s tax debt, including from overseas-based student loan borrowers, has risen significantly over the last few years, and as the minister of revenue, I have been clear that addressing this is a priority,” he said.

“That’s why in Budget 2024, Inland Revenue received additional funding to increase collection activity with these borrowers.”

BRUCE MACKAY / The Post

He doubted an amnesty would be effective.

“While an amnesty sounds like an attractive idea, there are likely to be many reasons why OBBs may not be complying with their repayment responsibilities besides the size of their penalties.

“When an amnesty was put in place in 2006 (and extended in 2007) only 30% of borrowers in default took this up with many failing to meet the terms of the amnesty to remain compliant for 2 years.”

Watts encouraged OBBs to get in touch with Inland Revenue.

Since July 1, he said 8500 repayment arrangements with borrowers in default had been arranged.

Green Party MP Lawrence Xu-Nan said overdue debt would only increase more rapidly as a result of the recent rise in penalty interest rates.

Abigail Dougherty / Stuff

Forgiving penalty interest on a large scale would mean a hit to the Government’s accounts, says Council of Trade Unions’ economist Craig Renney.

It may also not be a signal the Government was willing to send, especially to those who repaid their student debts diligently, and might feel a “little bit cheated” by penalty interest forgiveness.

Student loans represented a big investment by the country in young people, Renney said, and part of the scheme’s design was to make it costly to take skills learned in tertiary education overseas.

“It’s really important they contribute back to the country,” Renney said.

But, he said the country should also ask why so many young people felt they needed to head offshore.

ROBERT KITCHIN / ROBERT KITCHIN

“For many people, the key driver is lower wages in New Zealand compared to other jurisdictions,” Renney said.

Subscribe

Get insights sent direct to your email.