Reversing the Decline: The Current State of New Zealand’s Investor Visa Program articles

Date

12 Jul 2024

Related Expertise

“…We’ve had numbers of investors drop off a cliff and we need to get those numbers up again…”

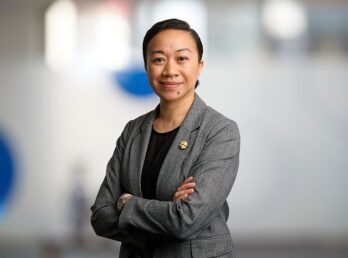

Those were the remarks from the Immigration Minister Erica Stanford 2-months ago[1] about the drastic drop in the number of wealthy investors wanting to move to New Zealand.

Investor visas have long been a cornerstone of New Zealand’s immigration policy, attracting more than 3,000 applicants and families to invest more than NZD$14 billion since 2009 through the Investor 1 and 2 resident visas. Investors had the option of investing NZD$10 million for 3 years, or NZD$3 million for 4 years with most choosing lower risk managed funds and bonds.

Statistics from July 2013 to May 2024 show the top 10 countries of origin for Investor 1 and 2 resident visa applications and approvals:

Country Approval Decline Total 1 China 1467 787 2263 2 USA 284 102 386 3 Great Britain 119 54 173 4 Hong Kong 109 53 162 5 Germany 87 39 126 6 Japan 52 15 67 7 Singapore 55 14 69 8 Malaysia 32 24 56 9 South Africa 29 30 59 10 South Korea 31 17 48 The landscape evolved with the introduction of the Active Investor Plus visa in September 2022 by the previous Labour Government, replacing the Investor 1 and 2 resident visas. The Government aimed to leverage the expertise and active involvement of high-net-worth individuals (HNWI) to foster innovation and growth in local companies, while providing a flexible and secure pathway to residence. Our previous article in February 2023 highlighted the key features of the Active Investor Plus visa.

At its core, the visa mandates an investment based on NZD$15 million. However, the actual amount hinges on the type of investment based on a weighting system, which can reduce the actual investment to NZD$5 million. The funds can also be incrementally invested over three years, with the full investment held for a fourth year. The residency requirement is a minimal 117 days in New Zealand across the 4-year conditional visa period.

Besides the investment requirements, this investor visa has an English requirement for the principal applicant, who must demonstrate an English-speaking background or undertake an English language test. Applicants must also meet health and character requirements.

Risk v reward – a delicate balancing act

The Active Investor Plus visa was described in a December 2022 Briefing as “highly novel” creating a contest between the desirability of New Zealand as a destination and the instinct to preserve and protect wealth.

The goal was to attract at least 50 new investors each year, investing about half a billion dollars into the country.

To date, only 52 Active Investor Plus visa applications have been received, although 6 were subsequently withdrawn, with strong interest from the United States, and Hong Kong, followed by Germany, UK, and China. Of the 46 applications, only 20 have been approved with resident visas issued, and a further 14 approved in principle who are now able to invest, working towards being fully approved.

This represents about $500 million invested in New Zealand – 44% directly into local companies, 11% into managed funds, and 45% into listed equities.[1] This indicates less than half the investors are opting to obtain residence at a lower cost of investing NZD$5 million in Direct Investments which carries a higher level of financial risk. However, over half are willing to invest more and up to NZD$15 million in low-risk managed funds and equities. The Government will be reflecting on whether it still believes it is best to have fewer people investing more or whether this, in fact, defeats its original objective of encouraging more Direct Investment.

This also indicates New Zealand may be missing out on potential investor migrants because the instinct for lower risk is likely to prevail when seeking to enter a new and unfamiliar market. Those investors who might have NZD$5 million to invest are likely to explore competing markets for opportunities if they perceive the risk associated with Direct Investments to be too high, or just practically too difficult.

Acceptable Direct Investments and Managed Funds are determined solely by New Zealand Trade and Enterprise (NZTE) who assess and approve applications from providers. However, NZTE does not undertake due diligence on these investments so there is a significant onus, and risk, on individual investors to undertake their own research. This is a tall order for someone unfamiliar with the New Zealand market.

Can we expect changes?

The Active Investor Plus visa has since been criticised for being complex, high-risk, and impractical. To date, the stark drop in numbers of investor migrants indicates that New Zealand is losing out on significant investment, but the NZTE assures that the current numbers are on track, and the right investors are being approved.

There is increasing commentary that changes are needed to simplify the policy settings for the Active Investor Plus category, one that not only secures immediate investment but also fosters long-term commitments.

A 12-month Implementation Review from the Ministry of Business, Innovation and Employment (MBIE) was due at the end of 2023, inviting the Minister to report back to Cabinet on the outcomes of the review. Perhaps this Review will shed light into how the Minister proposes to attract investors and “get those number up again”, either way, the balancing act between risk and reward remains the pivot around its success.

In early 2024, Australia effectively closed its Significant Investor Visa (SIV) known as the Gold Visa program. Most recently, Australia introduced more restrictive policy settings for the coming year with the aim to reduce net migration. From July 2024, it will close off applications for its Business Innovation and Investment (Provisional) visa (BIIP) noting poor economic returns.

The recent Henly Private Wealth Migration Report 2024 estimates that 2024 could see an unprecedented 128,000 millionaires to relocate worldwide, dubbing it as a “great millionaire migration”. It further lists New Zealand as one of the top 10 countries to watch due to its strong potential to attract millionaires in the future.

New Zealand is in good stead to benefit and leverage from the recent changes in Australia but will depend on how the Government responds to the review and changes (if any) to the policy settings.

Stace Hammond Lawyers offers comprehensive immigration and legal services, including tailored investment solutions. Let our wealth of experience and extensive contacts with Immigration New Zealand work to your advantage. Get in touch with us today.

[1] https://www.rnz.co.nz/news/national/513785/nz-missing-out-lawyers-say-as-visas-for-wealthy-investors-plummet

[2] https://www.nzte.govt.nz/blog/investor-migrant-update-april-2024

Subscribe

Get insights sent direct to your email.